Are you planning your next garage sale? If you are among the thousands of annual garage sale hosts that only offer items once a year, you will most likely not need a business permit. Generally, hosting one garage sale within a year does not qualify as a business for municipal or tax purposes.

However, use due diligence to ensure that your community does not require a local permit or license, nor that you are required to pay income taxes on the profits. In some areas, you may need to charge sales tax on the cost of the items you sell.

Table of Contents

Research Laws Before You Sell

Although many people think it is better to ask forgiveness than to seek permission, it is in your best interest to research local, state, and federal laws regarding any taxes or permits required for your garage or yard sale.

Don’t forget to read through your local HOA (homeowner’s association) bylaws, as well. Many HOAs restrict hosting a garage or yard sale to specific dates to minimize traffic into the area.

Business License or Permit

Some communities have requirements to purchase a temporary business license or request a permit to host a garage or yard sale. The primary purpose of this is to alert the police and fire departments of additional traffic in an area in accidents or emergency response to homes in the neighborhood. Their concern is for safety and the ability to respond to residents without delay.

Typical Municipal Garage Sale Regulations

Although each community will be different, a few similar regulations across the country are in place.

- The number of garage sales an individual may hold each year,

- How many consecutive days sales may occur,

- Signage – size, location, and number of signs to be posted

- Removal of signage and fines for non-removal,

- Requirements to remove all items from a yard or driveway overnight,

- The number of vehicles or participants at a property during the sale,

- Health Department restrictions on food sales.

While these are general regulations, be sure to check with your community before advertising your sale.

Know the State and Federal Tax Laws

According to the IRS, “If you sold an item you owned for personal use, such as a car, refrigerator, furniture, stereo, jewelry, or silverware, your gain is taxable as a capital gain.”

The typical garage sale host sells items already purchased and for which they already paid the taxes. As such, the amount you make on a sale is likely to be less than what you paid for it; therefore, there is no capital gain.

Many communities understand the occasional garage or yard sale only brings in a couple of hundred dollars. It is not a lucrative business, and most states and the federal government have classified the types of garage sales as:

- Casual – to get rid of stuff they no longer need and make a little money

- Hobby – to sell something, hopefully, to earn a profit.

- Business – to make a profit on all sales

In most cases, the state does not have the resources to police casual garage sales and enforce sales tax collection on a couple of hundred dollars. To be within the law, you should make sure you follow any tax guidelines within your state.

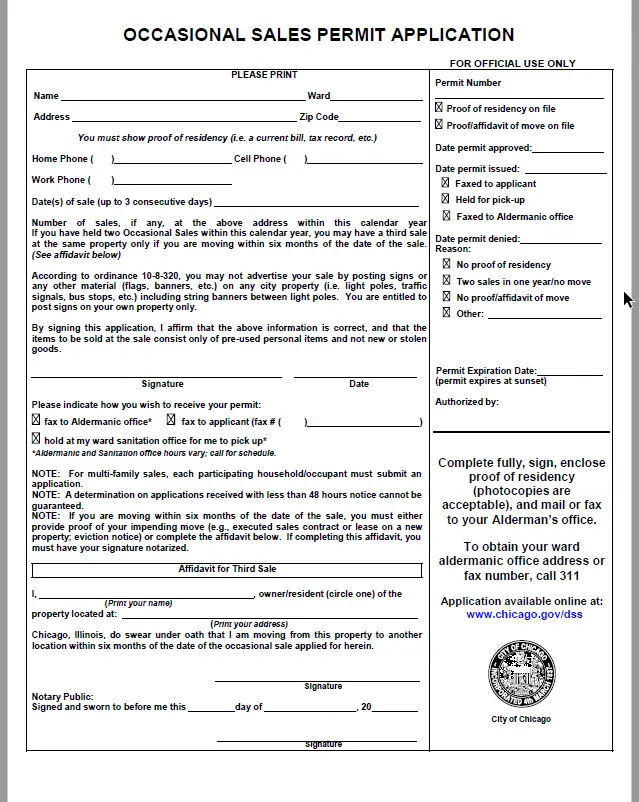

Example of a Garage Sale Permit

Below is an image of an example of a garage sale permit for Chicago, IL. This is just to be used as an example and is not an official form you should complete or expect to be up-to-date.

Examples of Garage Sale Ordinances

Azusa, California

Disclaimer: The information provided here is not tax or legal advice. Know that every municipality and state are different, and it is your responsibility to research the regulations where you live.