Garage sales are a great way to make a little extra money while also getting rid of things you no longer need. The question is… is the money you make from a garage sale taxable? Let’s figure it out.

Disclaimer: We are not tax professionals but we did consult with our CPA and verified that information through various government sources online.

You’d think income generated from garage sales or yard sales would be taxable like any other side-income, but there’s a unique reason why it’s not. Garages sales are typically full of items being sold for LESS than what you originally paid for them. Since you’re selling the items for less than you paid, you are not technically making a profit.

If you purchased items at a certain price, but sold them at your garage sale for more money, and make a profit, that would be taxable. So if you had a side-hustle of buying up dozens of shoes you got a great deal on, and marked them up for a profit, THAT money would be taxable. Since that’s not how garage sales typically work, we’re confident in telling you not to worry about taxes for garage sales.

Here’s real world example:

Item: Used Leather Sofa

You originally paid: $1000

You sell it for: $400

In the eyes of the IRS, this is a loss and cannot be taxed. It also can’t be deducted, unless you were to donate it which we’ll get into next.

Can I write-off items at my garage sale?

No, you cannot write-off the items sold AT your garage sale, but you may be able to donate items to approved 501(c)3 non-profit organizations and take a tax deduction. If you think your itemized deductions won’t exceed the standard deduction, then donating the items will not benefit your tax situation.

Do I have to charge sales tax at my garage sale?

This can vary by state but the answer is probably not. Most states treat garage sales as “occasional sales” or “casual sales”. Like we mentioned earlier, most garage sales aren’t profiting or paying taxes on their income, so you don’t need to worry about sales tax in those cases. If you are concerned about this we highly suggest consulting a local tax professional.

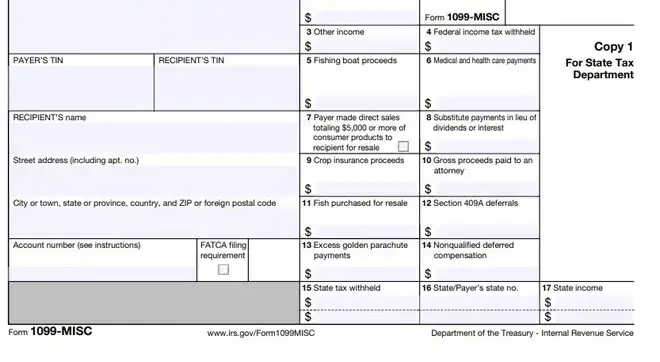

The good news for most of you is you don’t need to fill out any forms like the one below!